Our research has revealed that parents are having a wide-ranging influence on their children’s step onto the property ladder. In addition to allowing their children to move back home to save for a deposit, we found that parents can often be heavily involved in deciding which type of house their children buy.

Many also choose its location and even veto decisions if they’re not happy with them, perhaps if an area isn’t suitable. This just underlines how children can be reliant on guidance from mum and dad, as well as for financial help.

58% of parents contributed financially

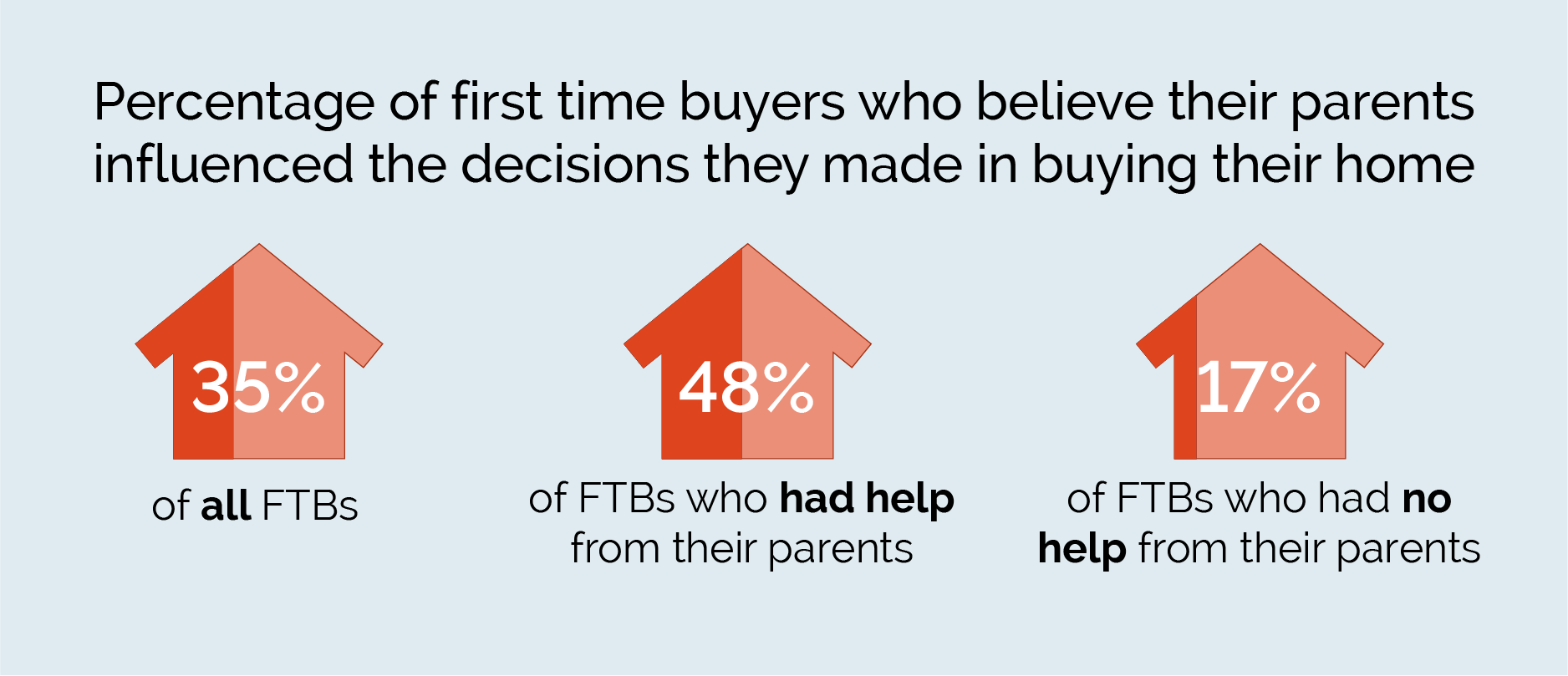

When surveyed, more than a third (35%) of the 1,001 people surveyed said that their parents had influenced their purchase in some way, whilst 58% said their parents had helped them generate the money to pay for a deposit, whether through a gift or allowing them to move back home to save.

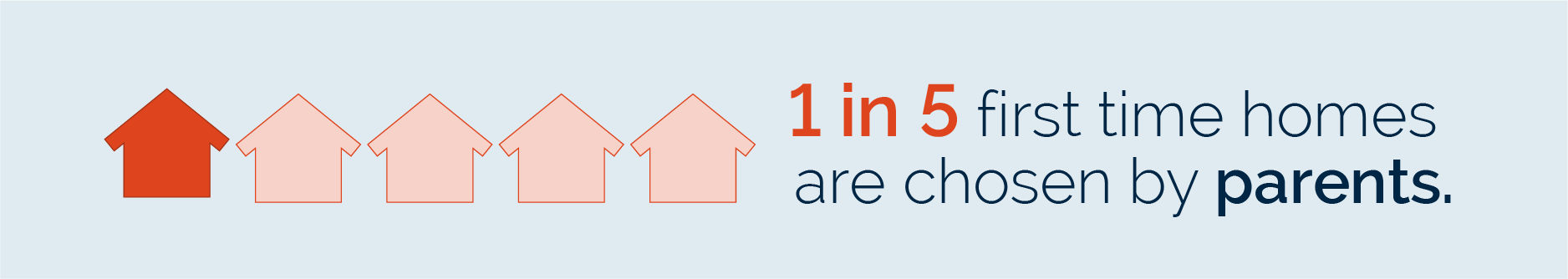

One in five homes are chosen by parents

Parents are often involved during the entire home buying process. Our research showed that one in five first time homes are chosen by parents, while 49% of first time buyers buy in areas suggested by their parents.

Parents’ concerns also stretch to the valuing of a home, with a third of parents worrying that a property is overvalued and that their children might be paying too much.

Parents aren’t shy in putting their foot down either. In addition to offering help, over a quarter (27%) of those asked said their parents had vetoed their buying decisions, and on average had said no to two properties.

Our recent Home Satisfaction Survey found that more than half (55%) of young homeowners live within 15 miles of their hometown, which suggests that parents are perhaps encouraging children to stay nearby rather than move far away.

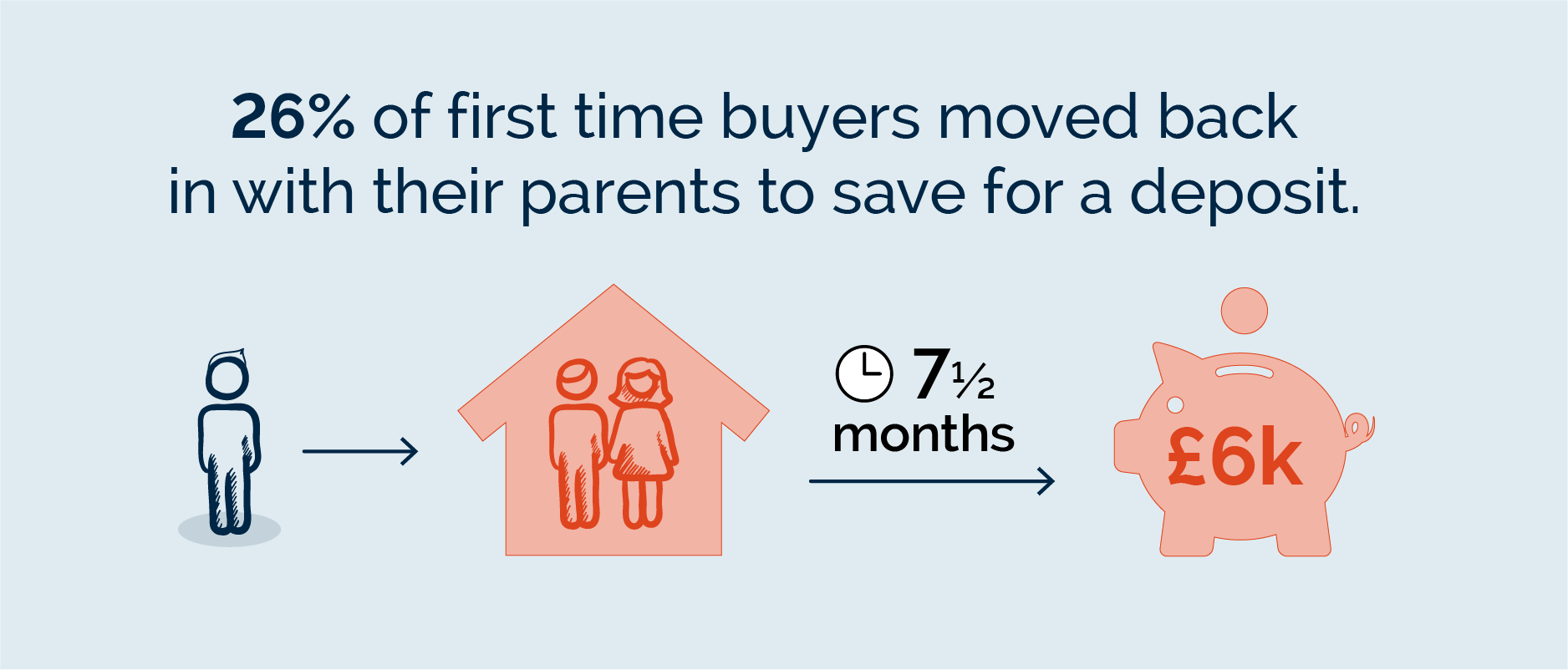

Moving back home is increasingly common

Over a quarter of first time buyers moved back home with their parents to help save for a deposit, rising to 43% in the 18-24 age bracket. Those who moved home were at their parents for an average of seven and a half months, whilst a third (33%) moved back for more than a year.

The benefits of moving home are clear for those looking to buy, with those asked able to save an average of £6,000 and over a fifth (22%) saving more than £10,000 towards the deposit of their first home.

Parents insisting their children buy a new build property

The role of mum and dad in their children’s step onto the property ladder has been well-reported over recent years, but we wanted to build a picture of just how much of an influence parents are having.

With one third of homes actually picked by parents and a quarter (25%) steering their children to buy a new build property, we found that parents are more heavily involved than we once thought.

David Wilson Homes is committed to helping first time buyers onto the property ladder through beautiful homes across the country and our Home Reach shared ownership scheme.